EA to Be Taken Private in $55 Billion Acquisition by Saudi PIF, Silver Lake, and Affinity Partners

On Monday, Electronic Arts (EA) announced a definitive agreement to be acquired entirely by a consortium led by the Saudi Public Investment Fund (PIF) alongside Silver Lake and Affinity Partners. The all-cash-and-stock deal values EA at approximately $55 billion.

Details of the Agreement

Under the terms of the deal, the investor group will acquire 100% of EA’s outstanding shares. As part of the transaction, the Saudi PIF will roll over its existing 9.9% stake in EA.

Shareholders will receive $210 in cash per share, representing a 25% premium over EA’s unaffected stock price of $168.32 on September 25, 2025. Once completed, EA’s common stock will be delisted, transforming the publisher into a fully private company.

Leadership and Future Vision

In a statement, EA Chairman and CEO Andrew Wilson praised the company’s legacy and looked ahead with optimism:

“Our teams at EA have delivered extraordinary experiences to hundreds of millions of fans worldwide and created some of the most iconic IP in entertainment. This moment is a powerful recognition of their work. Looking forward, we will continue to push boundaries in entertainment, sports, and technology, creating transformative experiences that inspire future generations.”

Wilson will remain as CEO, and EA will continue to operate from its Redwood headquarters in California. The transaction is expected to close in the first quarter of fiscal year 2027, subject to regulatory and shareholder approvals.

Financing Structure

The acquisition will be financed through a mix of equity and debt. The PIF, Silver Lake, and Affinity Partners will collectively provide $36 billion in equity, which includes the rollover of the PIF’s current stake in EA.

The remaining $20 billion will be funded through debt financing exclusively arranged by JPMorgan Chase. Of this, approximately $18 billion will be drawn at closing.

Strategic Impact

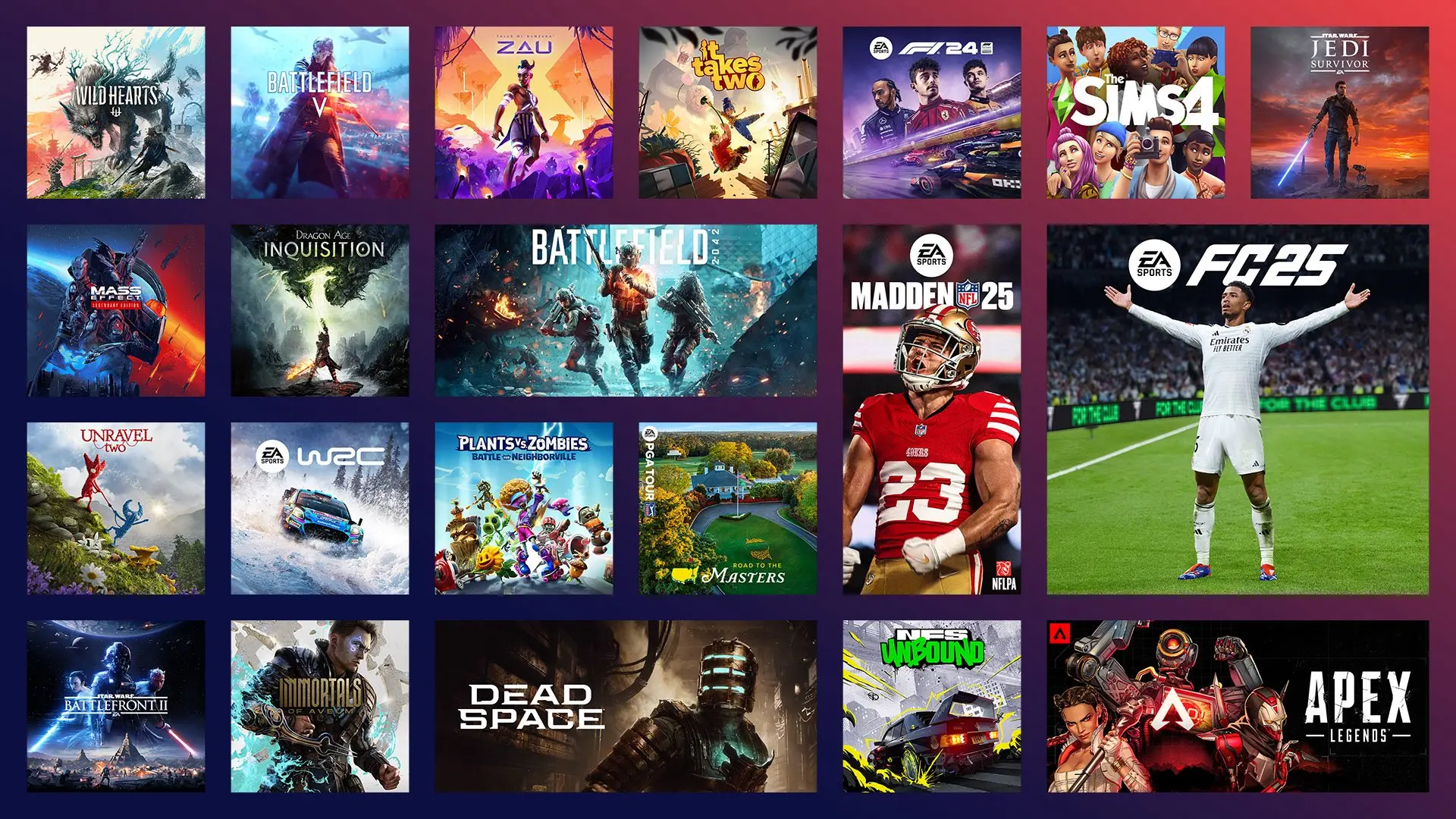

By becoming private, EA is expected to gain greater flexibility to innovate without the short-term pressures of the public market. With financial backing from PIF and partners, EA is positioned to accelerate its investments in new technologies, expand globally, and strengthen franchises like FIFA, Battlefield, and The Sims.

If finalized, this acquisition would mark one of the largest deals in gaming industry history, reshaping the future of interactive entertainment.